Cylindrical lithium-ion batteries are rechargeable cells that feature a solid, tube-shaped design—typically composed of layered anode, cathode, and separator materials rolled into a cylinder. Known for their shapes and better performance, cylindrical cells are among the most widely used lithium-ion formats in the market today in various applications, such as electric vehicles, power tools, and more.

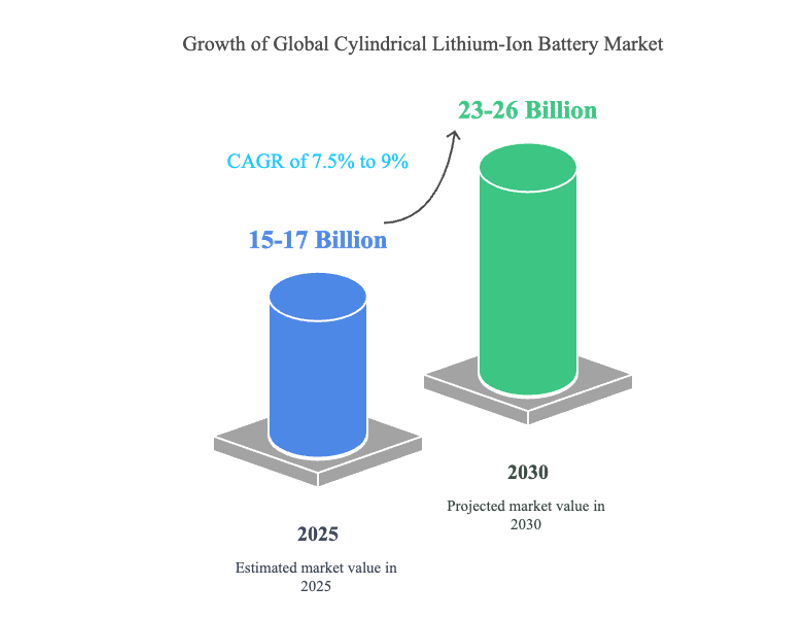

And this year, in 2025, the market of cylindrical lithium-ion batteries is valued at about $15 billion to $17 billion and is projected to grow at a compound annual growth rate (CAGR) of 7.5% to 9% in 2030.

But how can we better understand this market beyond such growth? In this article, we’ll explore the current market size, review the major types of cylindrical lithium-ion batteries, and examine key trends that are shaping their future development.

The Market Size of Cylindrical Lithium-Ion Batteries: Analyzed

The cylindrical lithium-ion battery market represents a significant and rapidly growing segment within the global energy storage industry.

Overall Production and Market Size in 2025 and Beyond

The global cylindrical lithium-ion battery market currently stands as a multi-billion-dollar industry with robust growth projections. As mentioned above, the market is estimated to be valued between $15 billion and $17 billion in 2025, with forecasts indicating continued expansion at a compound annual growth rate (CAGR) of 7.5% to 9% through 2030.

At this rate, the market is expected to reach between $23 billion and $26 billion by 2030, reflecting the increasing demand across multiple sectors.

Growth of the global cylindrical lithium-ion battery market

Data Source: “Cylindrical Lithium Ion Battery Global Market Insights 2025, Forecast to 2030”, Global Newswire, by Research and Markets, March 26, 2025

Geographic Distribution

The global cylindrical lithium-ion battery market demonstrates clear regional concentration patterns, with Asia-Pacific emerging as the dominant production and consumption hub. This geographic distribution reflects both manufacturing capabilities and end-use applications across different regions.

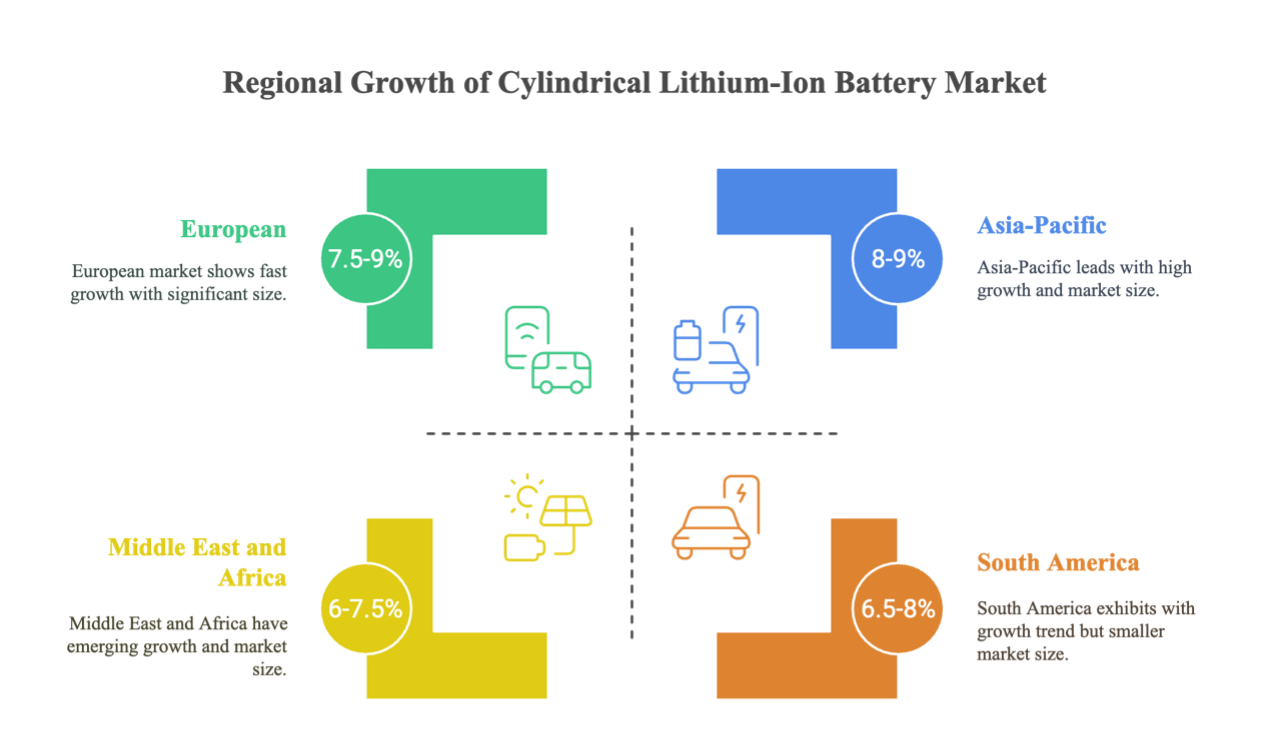

Regional growth of the cylindrical lithium-ion battery market

Data Source: “Cylindrical Lithium Ion Battery Global Market Insights 2025, Forecast to 2030”, Global Newswire, by Research and Markets, March 26, 2025

- Asia-Pacific Dominance

Asia-Pacific leads the global market with approximately 57% of market share. This region is experiencing a rapid growth rate of 8.0-9.5%, predominantly driven by China and South Korea. These countries have established themselves as centers of excellence for both EV production and consumer electronics manufacturing, creating substantial domestic demand for cylindrical lithium-ion batteries.

The manufacturing ecosystem in Asia Pacific–particularly in China–benefits from vertically integrated supply chains, advanced production expertise, and significant investments in battery technology. The regional trends favor mass production capabilities and cost-efficiency improvements to maintain a competitive advantage.

- European Expansion

Europe’s cylindrical lithium-ion battery market is growing at 7.5-9%, with Germany serving as the regional leader. The European marketplaces particularly emphasis electric vehicle batteries, with regional manufacturers and consumers showing a strong preference for sustainable, recyclable solutions that align with the EU’s environmental regulations.

- Emerging Markets

The Middle East and Africa (MEA) and South America represent smaller but growing markets for cylindrical lithium-ion batteries. The MEA region is growing at 6.0-7.5%, with the United Arab Emirates focusing on smart home applications. South America shows growth rates of 6.5-8%, with Brazil emerging as a key market for laptops and power banks.

Application Segment Analysis

As briefly mentioned above, the cylindrical lithium-ion battery market serves diverse sectors, with several key application segments driving demand and shaping product development priorities.

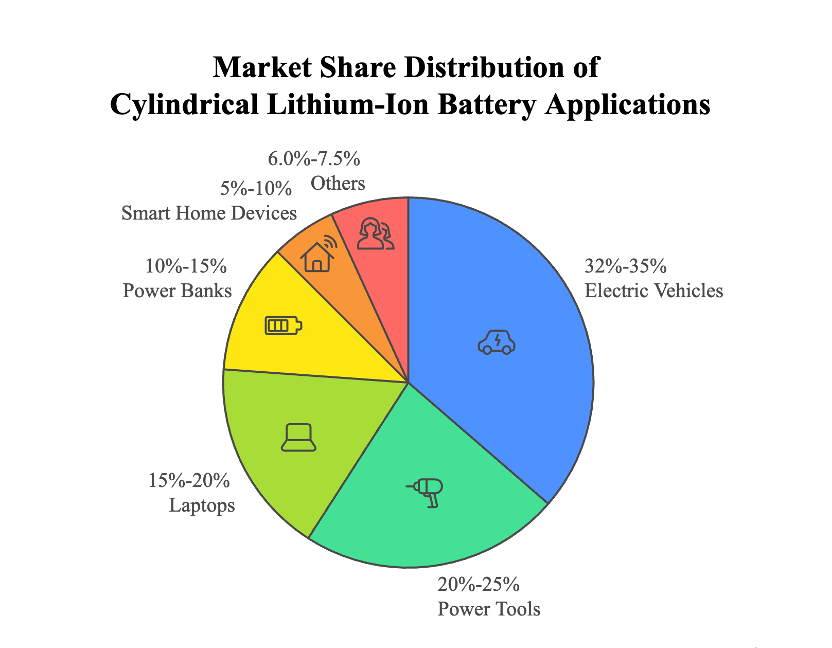

Market share distribution of cylindrical lithium-ion battery applications

Data Source: “Cylindrical Lithium Ion Battery Global Market Insights 2025, Forecast to 2030”, Global Newswire, by Research and Markets, March 26, 2025

- Automotive

The automotive sector represents the largest single application segment for cylindrical lithium-ion batteries, accounting for approximately 30-35% of the total market. This segment is also experiencing the fastest growth at 8.5-10%, propelled by the accelerating transition toward electric vehicles globally. Within the automotive category, these batteries are used in electric sedans, buses, e-bikes, and automated guided vehicles.

- Industrial Applications

Industrial applications constitute a significant market for cylindrical lithium-ion batteries, encompassing power tools, industrial equipment, and specialized machinery. The robust construction and reliable performance of cylindrical cells make them particularly suitable for these demanding applications, where durability and consistent power delivery are essential requirements.

- Consumer Electronics

Consumer electronics represent another major application segment for cylindrical lithium-ion batteries. These power sources are widely used in laptops, digital cameras, portable power banks, MP3 players, and various smart devices. The consumer electronics segment benefits from the high energy density and relatively low cost of cylindrical cells, allowing for longer device operation and competitive pricing.

- Other Specialized Sectors

Beyond the major segments, cylindrical lithium-ion batteries serve specialized sectors including:

— Aerospace and marine applications requiring high reliability

— Medical devices with stringent safety requirements

— Energy storage systems for renewable power integration

Each of these specialized segments places unique demands on battery performance, safety, and reliability, driving ongoing innovation in cylindrical cell design and chemistry.

The Major Types of Cylindrical Lithium-ion Batteries, Explained

Cylindrical lithium-ion batteries can be classified in various ways. But two of the most and industry-relevant methods are by battery material composition and by physical dimensions. Each type offers different characteristics in terms of energy density, safety, cost, and suitability for specific applications.

Categorized by Battery Materials

The internal chemistry of a lithium-ion battery significantly influences its performance and ideal use case. The most common material types and their benefits for cylindrical cells include:

| Types | Benefits |

| Lithium Cobalt Oxide (LiCoO₂ or LCO) | Excellent energy density and longer run time |

| Lithium Manganese Oxide (LiMn₂O₄ or LMO) | Improved thermal stability and enhanced safety characteristics |

| Lithium Iron Phosphate (LiFePO₄ or LFP) | Superior longevity and safety |

| Lithium Nickel Manganese Cobalt Oxide (LiNiMnCoO₂ or NMC) | Excellent balance of energy density, power capability |

Table 1: The Benefits of Several Major Chemistries on Cylindrical Lithium-ion Batteries

Sources: NEI Corporation(2015), TWAICE (2025), Wikipedia (2025)

Categorized by Dimensions

In addition to chemistry, cylindrical lithium-ion batteries are also distinguished by their size format, which affects how they are integrated into battery packs and systems. And in the market, 18650 and 21700 battery cells are two common cylindrical batteries. Here are the differences between the 18650 vs 21700 batteries:

| Features | 18650 Battery Cells | 21700 Battery Cell |

| Dimensions | 18 mm diameter x 65 mm length | 21 mm diameter x 70 mm length |

| Capacity (Max) | 3600mAh | 5000mAh |

| Energy Density | 250wh/kg | 300wh/kg |

| Lifespan | 300-500 Cycles | 500-800 Cycles |

| Cost | $155/kWh | $171/kWh |

Table 2: The Difference Between the 18650 vs 21700 Battery Cells

Source: “21700 vs 18650 Battery, Comprehensive Comparison”, ELB China by ELB, 2022-05-11

Future Trends of Cylindrical Lithium-Ion Batteries, Projected

How do the trends of cylindrical lithium-ion batteries shape the future of related industries? Here, we focus on key developments in performance capabilities and manufacturing processes, as well as the risks facing ahead:

In Performance

- Energy Density Advancements

One of the most significant performance trends is the continuing advancement in energy density. Current industry-leading cylindrical cells are already achieving remarkable energy densities above 800 Wh/L. This represents a critical breakthrough that enables applications like electric SUVs to achieve up to 450 miles of range with smaller battery packs.

- Chemistry Technological Evolution

As mentioned above, the chemical composition of cylindrical lithium-ion batteries is undergoing significant diversification. Many studies have mentioned the approaches to enhance the overall performance of cylindrical lithium-ion battery cells:

— LMFP powders specifically offer enhanced thermal stability, contributing to safer battery operations with reduced fire risks.

— Latest LFP cathode technology demonstrates 15-20% higher energy density compared to standard LFP batteries.

- All-Solid-State Battery Integration

All-solid-state batteries (ASSBs) represent a transformative advancement in energy storage, particularly for cylindrical battery cells. By replacing flammable liquid electrolytes with solid materials, ASSBs enable the use of lithium metal anodes, achieving energy densities more than 350 Wh/kg, thereby enhancing the compactness and efficiency of cylindrical cells.

In Manufacturing

Manufacturing facilities are dramatically increasing in scale while simultaneously improving production efficiency for cylindrical lithium-ion battery cells:

Automation and artificial intelligence are optimizing production lines for maximum yield and quality

With the rise of circular economy, battery recycling and second-life would become essential because of higher environmental pressure and the cost of raw materials.

Gigafactory development continues globally, with facilities capable of producing tens of gigawatt-hours annually.

Recent Giga-factory’s movement

Designed by Freepik. Re-edited by LEAD

Sources: Reuters (2022), CATL (2022), EVE (2023), Queen Creek Gov.(2024)

- — CATL and BMW Group announced a multi-year agreement for the supply of cylindrical battery cells, specifically 46mm diameter cells, for BMW’ new vehicle starting from 2026. These cells will be produced at two of CATL’s future battery plants in China and Europe, each with an annual capacity of up to 20 GWh dedicated to BMW Group.

- — Samsung SDI revealed plans to invest 1.7 trillion won (around $1.3 billion) in expanding its cylindrical battery manufacturing in Malaysia, aiming to strengthen its global competitiveness and position itself among the world’s leading battery producers by 2030.

- — LG Energy Solution is set to begin mass production of cylindrical batteries at its $5.5 billion facility in Queen Creek, Arizona, in the first half of 2026. The plant will help expand the company’s manufacturing capacity to meet growing demand from key clients like Rivian.

- — EVE Energy officially announced that it has approved an investment by one of its indirect subsidiaries to establish a large cylindrical battery production facility in Hungary. The project, aimed at serving the growing demand for power batteries in passenger vehicles, will involve a total investment of no more than 9.97 billion yuan.

To meet growing demand, manufacturers need advanced production systems that deliver high throughput, consistent quality, and intelligent automation.

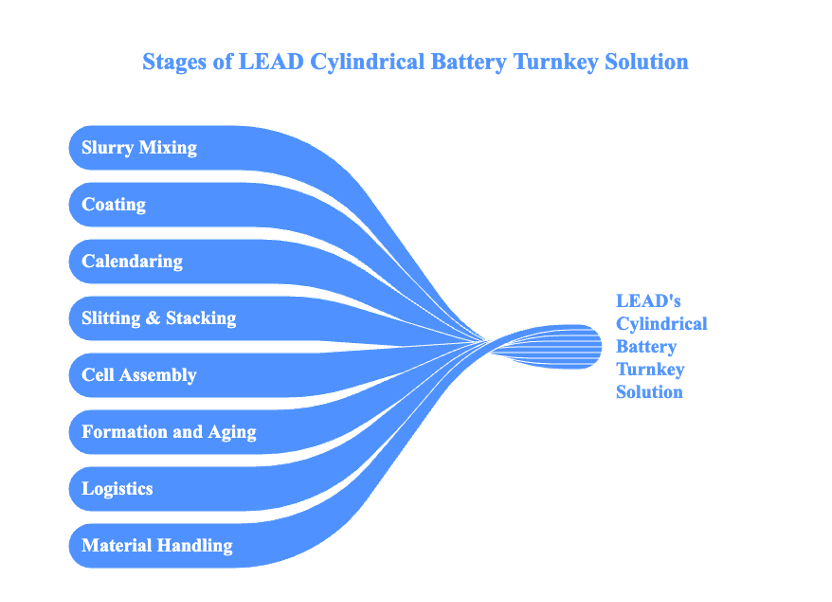

LEAD offers a comprehensive turnkey solution for cylindrical battery production–designed to support the next generation of scalable, efficient manufacturing.

LEAD’s Turnkey Solution on Cylindrical Cell

- End-to-End Process Coverage

LEAD’s cylindrical lithium-ion battery manufacturing solution includes equipment and systems for every stage of production. It enhances efficiency and reduces operational complexity.

- High Performance

LEAD’s solution for manufacturing cylindrical lithium-ion batteries achieves an average comprehensive availability rate of over 75%. It reflects a high standard of reliability and operational stability under continuous production demands.

- High Production Capacity

LEAD’s cylindrical battery production line is capable of delivering up to 1.6 GWh of annual output, making it suitable for both emerging manufacturers and established companies scaling toward gigafactory-level operations.

- Comprehensive Customized Project Delivery

In addition to equipment supply, LEAD offers complete customized project delivery services — from production line design and engineering to on-site implementation and technical support. We can offer a smooth transition from concept to full-scale production and meet your unique battery manufacturing requirements.

"*" indicates required fields